Probably one of the most expensive aspects of driving a car is the insurance needed. This is something that cannot be avoided and is unfortunately required by law. This does not mean you have to pay whatever your insurance provider says – there are some things you can do to help cut the cost of your premiums.

1) Use the internet to shop around and purchase insurance. Most people renew their insurance and never shop around. It is straightforward to go online and compare car insurance quotes from different providers. It only takes a few minutes and is free, so why not take advantage of it? Many insurers offer 10% discount or more, just if you purchase your policy online.

2) The type of policy. Do you need comprehensive cover, third party cover, or all the extras? If you get a third party cover with fire and theft, your premiums will drop significantly. If your car isn’t expensive, this is worth considering.

3) No claims cash back and discounts. Most providers these days offer discount or cash back for every year you do not claim. You can save a lot, depending on the amount of deduction available. Some insurers provide no claims bonuses for life. This will ensure your current discount level is fixed for life, even if you make a claim.

4) Amount of excess. This is the amount you need to pay before the insurer covers the rest. If you increase the excess amount, your monthly premiums will be higher. However, you will need to be able to pay that amount should you get into an accident for example.

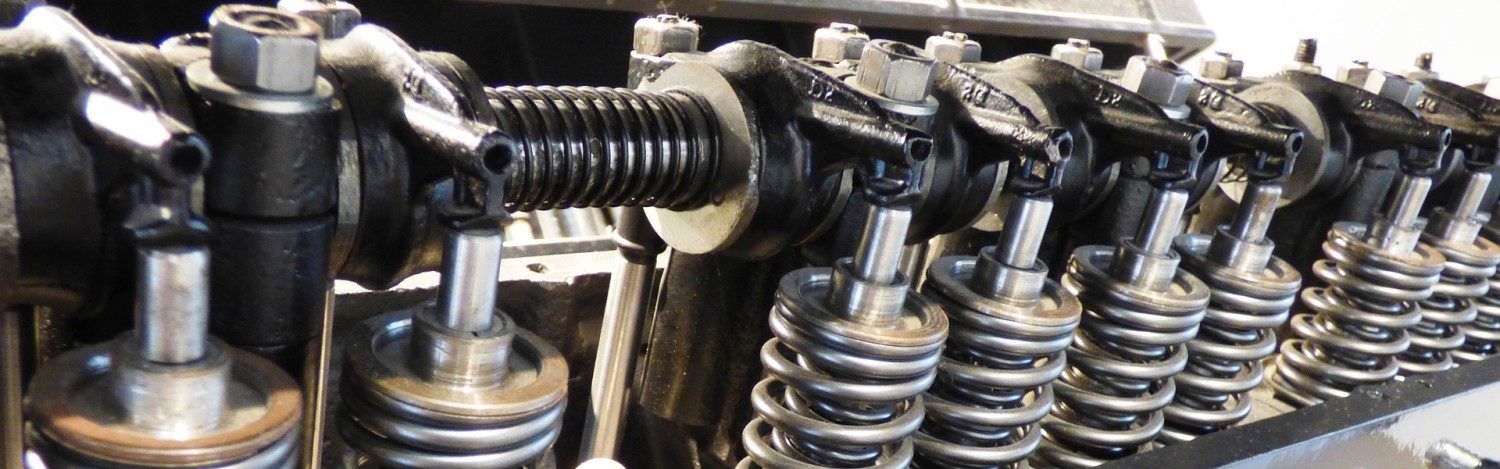

5) Security devices. If your car is safer, in other words, you have more security devices installed the insurance premiums will be lower. If your vehicle is parked in a locked garage, for example, it will also result in lower car insurance premiums.

6) Pay annually. Paying monthly might make it easier to plan your budget, but remember that some insurers charge interest when you pay monthly. If you can afford it, instead pay annually, or look for insurers that do not charge interest on monthly payments.

7) Mileage. The more you travel, the higher your risk of accidents, meaning higher insurance costs. It is not always possible to reduce your distance, just make sure you do not overestimate the mileage you drive.

8) Drivers. The more drivers you add to your insurance policy, the more expensive it will be. Try to reduce the number of insured people who drive your car, and get the policy in the name of the person with the lowest risk profile. If you are a man, for example, just by insuring it in your spouse’s name will already result in a cheaper quote.

If you found these tips useful, you can read more tips like these here.